The following is a review of the past week.

Goes without saying: please do your own due diligence and evaluate your own risk tolerance.

For more up to date information, you can just follow me on stocktwits: runner417. I plan to just use the blog as a "weekly report card" and "pontification session."

Charts to be posted later.

Overall Grade: C-

Past week's calls could have used some improvement. Overall next week, I'm feeling optimistic.

NUGT [F]: First of all, the overweight position in NUGT stopped out twice (because I bought back later). I did flip to DUST for a bit but the point is the call on NUGT didn't pan out at all, not even close.

After reviewing the charts again, I realized that I misinterpreted reading one of the cycle charts for NUGT. Moving forward, I think I have a better grasp of reading the cycle and will evaluate more as we go.

UGAZ (natural gas) [A] is a winner, and I think it will continue to be a winner into first week of December after it corrects Monday.

EDC/EEM [A] are both setting up to be winners heading into first week of December. The correction this week was expected after the rapid rise (and emotional gap up off of cycle high). Emotions are now reset, and should be free to run this week.

UVXY (vol) [C] short term pop was accurate but next time I would rather not even bother posting something so short term. It remains something to stay away from for the time being. Vol WILL catch up...nature finds a way (Jurassic Park flashback). It is nearing the end of a massive cycle and by the looks of it 2014 is going to be one crazy year. 2015 will be crazier (overall a "minor" correction in 2014 to be followed by a massive run up like 2009 into EOY 2015. Don't miss that run up because that could be the bubble of the bubble. I say minor because a 20-30% decline means nothing after a +150% runup). Maybe nature is getting very angry that nothing has been resolved on the debt ceiling, government spending front. Some market volatility can adjust that properly.

YINN (china) [A] works similarly to EEM but not really. YINN is also setting up for a run into December. China did pass notable reforms this past week, ones that stood out to me were abolishing the one child policy and allowing more private investment, less government intervention. The beneficial effects of this should be felt years from now but the market will price this in over time. You should see the baby stocks in China after the reform change. Pricing it in already:

http://www.reuters.com/article/2013/11/18/us-hongkong-babyshares-idUSBRE9AH01R20131118

That's the easy result of the reform change, but the underlying current is social. Single children have a very different view of the world versus those that have siblings. This can open up China and be more creative. There is a lot of pressure on single children and having siblings will ease the burden. I see this as being hugely beneficial 20 years out.

Despite what views you may have of China, the way the government is setup picks the strengths of different government types. First, the decisiveness of government and two the strengths of a capitalist economy. The future remains murky for US economics but Chinese economics remains very bright.

SPX [C]: trickiest chart of them all. There was a brief correction that was really a wave 4 and we likely ended wave 5 on Friday. ABC correction next then another buying spree into year end is the call...wave B should coincide with day before and after thanksgiving. Wave C probably be blamed on some "lower than expected Black Friday results." I really don't factor news in my trading because it's really noisy and I find it hard to believe that some reporter can dictate which way the market goes.

DRN (real estate) [C]: DRN is following a similar cycle to NUGT just not as bad so I readjusted the cycle interpretation, and we'll see this week. I think it bottomed and is heading short term higher to the 40s

TLT [B]: The correction midweek is likely an expanded flat (so wave B cut below wave A), so we should overshoot back up in wave C. Re-adjusted short term cycle for this. I did make some intraweek trades on TLT and so far have worked out ok so I will stick with the cycle.

A new one that I will add to the mix is oil (UCO or USO). I really think oil bottomed this past week and is ready to move up for longer term buy. I question how can oil be down so much when stocks are so high?

---

I will write a separate discussion on cycles and how I use them in my analysis in the future. In summary, I've seen more than my fair share of various indicators and I believe the theory that gives me the best confidence entering a trade is cycle theory.

It is the one theory that eliminates as much as possible the "what if" questions that pop up in my head. "what if the moving average does X or what if this wave is really a 3 legged up wave rather than 5?" These types of questions can easily affect an otherwise sound trading decision.

With cycles, the natural rhythm and flow of waves and how waves amplify when cycles overlap is something i have found to be the most intriguing and oddly, the most serene feeling in trading. I guess once you figure out the cycle and morph with that asset as "one" you see where the price goes beforehand and literally feel what market participants are feeling and it's amazing to see how that can work. Sounds hocus pocus, but I never one believed that analyzing markets needed a PhD.

It makes sense, the problem is interpreting the cycles right. Once you determine the master cycle for a given asset, you can capitalize on short term emotional trading (i.e. stock gets beaten down but cycle is up...what that tells me is at some point once the emotional trading is out of the way, the stock just flat out rips to catch up.) Nature has a funny way of correcting itself. Really really interesting stuff.

I use cycle theory to figure out the time aspect, then use standard TI to figure out the price aspect. I then use Elliott Wave to determine how best the wave will end. All of this stuff is not easy at first but once you become one with nature and the natural rhythm, it is quite eye opening.

ZtradeZ - Market ETF Swing Trades by Z

ETF swing trades and market insight - primarily focused on SPX. Leveraging traditional technical analysis, cycles, elliott wave, P&F, and oscillators to identify continuations and change in trend. Updated frequently.

Saturday, November 23, 2013

Sunday, November 17, 2013

11/17/13: The week ahead

Likely catalyst this week: FOMC Minutes 2pm EST Wed, so will be cautious on existing positions moving into that time frame.

The following are top ideas, current, and potential positions. I am deviating away from purely posting SPX (seems to get boring and secondly haven't made the right calls past month :p) Some are duplicative of what I posted previously. Goes without saying: please do your own due diligence and evaluate your own risk tolerance.

I intend to update this at the start of the week, mid week update, and EOW review. For more up to date information, you can just follow me on stocktwits: runner417.

Top 3 Ideas - week of 11/17/13

1. Long NUGT [Gold Miners] (discl: O/W position on NUGT)

Looking for explosive move in NUGT this week. Potential IHS, positive reversal on CCI 8 (short term momentum), falling bullish wedge on hourly on Friday, extreme negative sentiment on gold miners, IT/LT hourly cycle moving up, ST cycle bottomed on Friday.

Potential max target ~high 50s so a move of approx. +30%-40% potentially

A gap down Monday may nix this setup so I will be watching before market hours and open.

2. Long EDC/EEM [Emerging Markets] (discl: no posn currently)

Huge gap up on Friday indicates big time mood change. Emerging markets has significantly underperformed SPX during the past several months, needs to play catch-up a bit. Possible asset allocation among fund managers as SPX has been in semi-melt up mode but similar risk assets have been imploding. Looking for a minor retrace to digest gains Mon/Tues and then a possible completion of a C leg up from 28.5 to 32.5 [EDC] (approx 10-15+% move)

3. Long UGAZ [Natural Gas] (discl: no posn currently)

Natural gas has been a short's heaven ever since 2009. I'm no pro at the underpinnings of natural gas but based on the chart I see and from evaluating the cycles, I'm looking for a retrace to around 13.5 on UGAZ Mon/Tuesday and then a rise into end of week with the potential of capping in the 16-17s range so this translates to an approximately 20-25% rise from 13.5. I think natural gas has the potential for making a bullish run.

Existing Positions outside of Top Ideas for this week

1. Long TLT [20Y govvies] [discl: long]

Big picture I don't like government bonds at all but TLT's been beaten down quite a bit and the LT/ST cycle hourlies are moving up this week so hence I'm long. I will look to be disposing TLT towards end of the week. This doesn't generate enough ROA to allow a decent allocation but I thought it was oversold enough.

The long term bond bull run is nearing its end and we're probably at the cusp of the turning point. I think there has increasingly been negative sentiment towards bonds so bonds are going to zigzag all the time but bottom line is it's not something I want to own into 2020. With the billions of $ in bonds, this money will eventually flow elsewhere and it's going to go into the cream of the crop assets....that very well likely could be one last MASSIVE melt up run into stocks (current meltup will look like kiddie meltup when this goes into hyperdrive). Think about it, when you manage your 401k the top two choices are bonds or stocks. Well, if bonds are hitting the crapper, then your other alternatives are stocks and cash. Since stocks are performing so much better and Fed rates near 0, what else can you do?

So moving into next two years, bonds are going to get hit hard and stocks are going to the moon. This might be the last bubble for stocks and in this case it's the entire US stock market (not just some sector like housing or tech). This has very dire consequences and a crisis that will make 2008 look like it was nothing. Meltups never ever end well (go back 1000 years and look at every bubble that has transpired). That is the concern moving into two years from now. In the meantime, there is nothing one can do about it but it will come like winter arrives after fall.

2. Long SPXU (short SPX) [discl: long]

What has been frustrating this year has been the SPX. Didn't think the semi-meltup would be this quick but lo and behold this year SPX is up +25% YTD. Wow. Anyway, I missed the October rally and have not been right in November as well so it gives me some nervousness to make a call on SPX.

I have a tight stop on SPXU but STILL think a near term correction is in the works before another rally into year end.

Potential Positions outside of Top Ideas

1. Long UVXY [volatility]

This goes hand in hand with a short SPX call. UVXY looks to have bottomed ST so I'm trying to get a 5-10% pop on this before selling it. Can't hold this thing for any longer than a few days.

2. Long YINN [China]

China released sweeping reform notably relaxing the one child policy. I think China is making the right adjustments as they position themselves in the early stages of what is clearly a massive up cycle. China reminds me of the late 80s US so it's time in the spotlight will come. There will be more and more opportunities in China.

YINN popped huge on Friday (+10%). I think there is a small retrace and then I want to position myself for a leg up towards EOW.

3. Long DRN (Real Estate)

I don't really know what to make of it but RE, commodities, emerging markets have all sucked hard while SPX has been making new all time highs each day. Real Estate looks to have made a short term bottom so I'm looking to grab a position this week for a leg up.

The following are top ideas, current, and potential positions. I am deviating away from purely posting SPX (seems to get boring and secondly haven't made the right calls past month :p) Some are duplicative of what I posted previously. Goes without saying: please do your own due diligence and evaluate your own risk tolerance.

I intend to update this at the start of the week, mid week update, and EOW review. For more up to date information, you can just follow me on stocktwits: runner417.

Top 3 Ideas - week of 11/17/13

1. Long NUGT [Gold Miners] (discl: O/W position on NUGT)

Looking for explosive move in NUGT this week. Potential IHS, positive reversal on CCI 8 (short term momentum), falling bullish wedge on hourly on Friday, extreme negative sentiment on gold miners, IT/LT hourly cycle moving up, ST cycle bottomed on Friday.

Potential max target ~high 50s so a move of approx. +30%-40% potentially

A gap down Monday may nix this setup so I will be watching before market hours and open.

2. Long EDC/EEM [Emerging Markets] (discl: no posn currently)

Huge gap up on Friday indicates big time mood change. Emerging markets has significantly underperformed SPX during the past several months, needs to play catch-up a bit. Possible asset allocation among fund managers as SPX has been in semi-melt up mode but similar risk assets have been imploding. Looking for a minor retrace to digest gains Mon/Tues and then a possible completion of a C leg up from 28.5 to 32.5 [EDC] (approx 10-15+% move)

3. Long UGAZ [Natural Gas] (discl: no posn currently)

Natural gas has been a short's heaven ever since 2009. I'm no pro at the underpinnings of natural gas but based on the chart I see and from evaluating the cycles, I'm looking for a retrace to around 13.5 on UGAZ Mon/Tuesday and then a rise into end of week with the potential of capping in the 16-17s range so this translates to an approximately 20-25% rise from 13.5. I think natural gas has the potential for making a bullish run.

Existing Positions outside of Top Ideas for this week

1. Long TLT [20Y govvies] [discl: long]

Big picture I don't like government bonds at all but TLT's been beaten down quite a bit and the LT/ST cycle hourlies are moving up this week so hence I'm long. I will look to be disposing TLT towards end of the week. This doesn't generate enough ROA to allow a decent allocation but I thought it was oversold enough.

The long term bond bull run is nearing its end and we're probably at the cusp of the turning point. I think there has increasingly been negative sentiment towards bonds so bonds are going to zigzag all the time but bottom line is it's not something I want to own into 2020. With the billions of $ in bonds, this money will eventually flow elsewhere and it's going to go into the cream of the crop assets....that very well likely could be one last MASSIVE melt up run into stocks (current meltup will look like kiddie meltup when this goes into hyperdrive). Think about it, when you manage your 401k the top two choices are bonds or stocks. Well, if bonds are hitting the crapper, then your other alternatives are stocks and cash. Since stocks are performing so much better and Fed rates near 0, what else can you do?

So moving into next two years, bonds are going to get hit hard and stocks are going to the moon. This might be the last bubble for stocks and in this case it's the entire US stock market (not just some sector like housing or tech). This has very dire consequences and a crisis that will make 2008 look like it was nothing. Meltups never ever end well (go back 1000 years and look at every bubble that has transpired). That is the concern moving into two years from now. In the meantime, there is nothing one can do about it but it will come like winter arrives after fall.

2. Long SPXU (short SPX) [discl: long]

What has been frustrating this year has been the SPX. Didn't think the semi-meltup would be this quick but lo and behold this year SPX is up +25% YTD. Wow. Anyway, I missed the October rally and have not been right in November as well so it gives me some nervousness to make a call on SPX.

I have a tight stop on SPXU but STILL think a near term correction is in the works before another rally into year end.

Potential Positions outside of Top Ideas

1. Long UVXY [volatility]

This goes hand in hand with a short SPX call. UVXY looks to have bottomed ST so I'm trying to get a 5-10% pop on this before selling it. Can't hold this thing for any longer than a few days.

2. Long YINN [China]

China released sweeping reform notably relaxing the one child policy. I think China is making the right adjustments as they position themselves in the early stages of what is clearly a massive up cycle. China reminds me of the late 80s US so it's time in the spotlight will come. There will be more and more opportunities in China.

YINN popped huge on Friday (+10%). I think there is a small retrace and then I want to position myself for a leg up towards EOW.

3. Long DRN (Real Estate)

I don't really know what to make of it but RE, commodities, emerging markets have all sucked hard while SPX has been making new all time highs each day. Real Estate looks to have made a short term bottom so I'm looking to grab a position this week for a leg up.

Friday, November 15, 2013

11/15/13: Current positions

Market fulfilled its IHS duties. Since today we didn't correct, I'm guessing Monday/Tuesday we do to make up for it. Afterwards, that retrace should be bought.

Longs

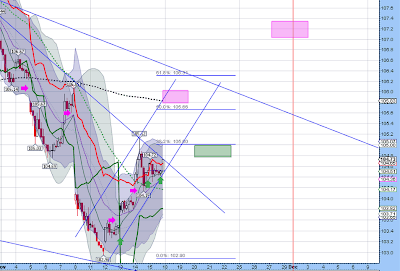

Long GDX/NUGT (gold miners): targeting around 60s on NUGT thanksgiving time (may revise this to high 50s) (chart below)

Long TLT (20y bonds): targeting somewhere around 107-108 next week or so

Long SPXU (short SPX): since Friday didn't bottom, took a small position with tight stop

Closed Positions

Long EDC (emerging mkts): huge gap up today so closed the position and am waiting for retrace next few days to re-enter and go long again

Planning to put on position

Long UPRO: when SPX short term bottoms Monday/Tuesday (hopefully)

Longs

Long GDX/NUGT (gold miners): targeting around 60s on NUGT thanksgiving time (may revise this to high 50s) (chart below)

Long TLT (20y bonds): targeting somewhere around 107-108 next week or so

Long SPXU (short SPX): since Friday didn't bottom, took a small position with tight stop

Closed Positions

Long EDC (emerging mkts): huge gap up today so closed the position and am waiting for retrace next few days to re-enter and go long again

Planning to put on position

Long UPRO: when SPX short term bottoms Monday/Tuesday (hopefully)

Thursday, November 14, 2013

11/14/13: Flipping bullish through year end

Market is on a tear and on my short positions were stopped out. I did a reevaluation of where the markets stand now and it seems a couple cycles have inverted...at least that's my best guess. One of the cycles I look at (86 hours) is trending up while the 55 hourly cycle should be bottoming in the next couple of days. Given the market has held up very well through the 55 hourly cycle, I am thinking we will exit 2013 with a bang.

Not sure how far up the market goes but if both of these cycles are trending up while the past cycle was inverted then I see markets heading much higher. I guess the 1850-1900 crowd were right.

Anyway, took off the short positions.

Moving forward, I should disclose my other positions.

Long GDX/NUGT (gold miners): targeting around 60s on NUGT thanksgiving time

Long EEM/EDC (emerging markets): targeting around 31 on EDC thanksgiving time

Long TLT (20y bonds): targeting somewhere around 107-108 next week or so

Stopped out positions

Long SPXU (short SPX)

Planning to put on position

Long UPRO: provided Friday is a down day. It looks like 5 hour and 16 hour cycles are bottoming tomorrow.

Not sure how far up the market goes but if both of these cycles are trending up while the past cycle was inverted then I see markets heading much higher. I guess the 1850-1900 crowd were right.

Anyway, took off the short positions.

Moving forward, I should disclose my other positions.

Long GDX/NUGT (gold miners): targeting around 60s on NUGT thanksgiving time

Long EEM/EDC (emerging markets): targeting around 31 on EDC thanksgiving time

Long TLT (20y bonds): targeting somewhere around 107-108 next week or so

Stopped out positions

Long SPXU (short SPX)

Planning to put on position

Long UPRO: provided Friday is a down day. It looks like 5 hour and 16 hour cycles are bottoming tomorrow.

Monday, November 11, 2013

11/11/13: Been awhile

Been awhile since I last updated. Since then, just been busy though at the same time, kind of disappointed we're in this sideways meandering market. Something's got to give...very soon. Traders don't like low volatility.

So I'm still targeting somewhere in the vicinity of 1600. Timing is off but ultimately the big picture is 1600. I guess I'm quite early, but looking for weakness into end of year. On the daily chart (not posted), it appears we're in this phase where the bulls feel like they can't lose and the bears are too afraid to short. So market has been quite successful in moving bears to the sidelines (or converting bears to bulls) and getting people off the sidelines to buy the dips (every dip has been bought regardless of how small) but we haven't moved up much since 10/21 (maybe 1+%?)

Our first inkling of some sort of weakness is the lower low put forth on 11/7. Bears viciously moved markets down to the lower band of kelt (using 3 standard deviations so in other words, the move was significant). Bulls bounced back and ripped bears a new one again and now we're back to square one.

At end of day today, I shorted again. My reasoning is our stop line (chandelier exit) has moved down and price has moved up. I imagine those with automated triggers at chandelier exits may have been stopped out giving some opportunity for others to take a stab. My stop is about 5% above my entry (so position size is small enough to not lose much on capital but at same time give some buffer and let this trade work).

My short term target is back down near the long stop (green line) achieving a lower low. Again, still maintaining a bearish stance into end of year.

So I'm still targeting somewhere in the vicinity of 1600. Timing is off but ultimately the big picture is 1600. I guess I'm quite early, but looking for weakness into end of year. On the daily chart (not posted), it appears we're in this phase where the bulls feel like they can't lose and the bears are too afraid to short. So market has been quite successful in moving bears to the sidelines (or converting bears to bulls) and getting people off the sidelines to buy the dips (every dip has been bought regardless of how small) but we haven't moved up much since 10/21 (maybe 1+%?)

Our first inkling of some sort of weakness is the lower low put forth on 11/7. Bears viciously moved markets down to the lower band of kelt (using 3 standard deviations so in other words, the move was significant). Bulls bounced back and ripped bears a new one again and now we're back to square one.

At end of day today, I shorted again. My reasoning is our stop line (chandelier exit) has moved down and price has moved up. I imagine those with automated triggers at chandelier exits may have been stopped out giving some opportunity for others to take a stab. My stop is about 5% above my entry (so position size is small enough to not lose much on capital but at same time give some buffer and let this trade work).

My short term target is back down near the long stop (green line) achieving a lower low. Again, still maintaining a bearish stance into end of year.

Monday, October 21, 2013

10/21/13: as an aside

I posted this on daneric's blog regarding why I thought the next down wave ought to be larger than the more recent ones and figured what I wrote wasn't too bad:

I'm a believer that for the broad indices (not necessarily individual stocks), the news will fit whatever move the market makes. Market is up it's because of X and market is down, it's because of Y. To me, hence, news is meaningless for indices.

What matters to me is how investors react to what happens to the market? So let's say price starts going down...based on all the buying last few days and lack of support, there's a lot of stops to trigger. More stops triggered lead to more selling and it's a cascading effect. So, even though something small in the news may trigger the snowball effect, it's probably meaningless news in hindsight. By the time prices really snowball, then the media is like "Oh yea - it's because of X" and it's some big event that only becomes easily discernible after most of the damage has been done.

So what could be bigger than a default? No idea, but one thing is clear to me is how much worse we are at solving issues. Each drama has resulted in practically an 11th hour deal. This latest one almost brought the US to default (to the last day). It's hard to believe we suddenly figure out how to solve the next issue in a more timely manner. In fact the next issue is right around the horizon and time is running short.

To solve the issues, my hunch is the market wants to pressure decision makers way beforehand in order to urge decision makers to start resolving quickly.

Sunday, October 20, 2013

10/20/13: Looking for down wave to commence this week

Based on how the futures opened up Sunday evening, it seems like the markets want to pop in the morning. I'll look to add to shorts if that is the case.

Looking back on how I had forecasted, I did forecast a new all time high but revised it later. Maybe it's a lesson that I ought to stick to my guns a bit more.

Timing window wise, markets blew past a couple of the ones I was looking at. Usually if markets hit a high at the timing window then it takes a break into the next timing window, but in this case, the 16th and the 18th both ended up being highs. This tells me that the next down wave is at minimum 1720 (or around 77 on UPRO) by the 25th. We'll see how realistic this is.

There are numerous negative divergences floating around at the weekly, daily, and hourly level. There are too many to count...it's kind of pointless to list them all. At the same time, if this wave decomposes into 3 waves where A=C, then we tomorrow's pop will be as close as it gets to A=C.

The daily negative divergences are a bit egregious. Looking at the TSI, we've made about 4 negative divergences in a row. We no longer have a positive reversal setup on TSI...at each low this past year, TSI set up a positive reversal meaning a lower low on the TSI but a higher low on price. This generally leads to higher high.

In the most recent one that transpired, TSI did not make a lower low. At the same time, there is a large NYMO negative divergence. This seems to indicate to me that the next trip down will break our support line and head to 1600 (which is approx the 200MA - I use 233 as a fib avg). Then I think, a bounce up from 1600 to back test broken resistance...maybe in the 1700s area before another sizeable move down into the low 1500s.

Given I believe we are in a 3-leg upwards B wave that decomposes into A=C, then I am expecting a down wave to commence starting this week and into the end of October. I am expecting November to open weak but bounce up into Thanksgiving, then December weak(?)

Looking back on how I had forecasted, I did forecast a new all time high but revised it later. Maybe it's a lesson that I ought to stick to my guns a bit more.

Timing window wise, markets blew past a couple of the ones I was looking at. Usually if markets hit a high at the timing window then it takes a break into the next timing window, but in this case, the 16th and the 18th both ended up being highs. This tells me that the next down wave is at minimum 1720 (or around 77 on UPRO) by the 25th. We'll see how realistic this is.

There are numerous negative divergences floating around at the weekly, daily, and hourly level. There are too many to count...it's kind of pointless to list them all. At the same time, if this wave decomposes into 3 waves where A=C, then we tomorrow's pop will be as close as it gets to A=C.

The daily negative divergences are a bit egregious. Looking at the TSI, we've made about 4 negative divergences in a row. We no longer have a positive reversal setup on TSI...at each low this past year, TSI set up a positive reversal meaning a lower low on the TSI but a higher low on price. This generally leads to higher high.

In the most recent one that transpired, TSI did not make a lower low. At the same time, there is a large NYMO negative divergence. This seems to indicate to me that the next trip down will break our support line and head to 1600 (which is approx the 200MA - I use 233 as a fib avg). Then I think, a bounce up from 1600 to back test broken resistance...maybe in the 1700s area before another sizeable move down into the low 1500s.

Given I believe we are in a 3-leg upwards B wave that decomposes into A=C, then I am expecting a down wave to commence starting this week and into the end of October. I am expecting November to open weak but bounce up into Thanksgiving, then December weak(?)

Subscribe to:

Posts (Atom)