Likely catalyst this week: FOMC Minutes 2pm EST Wed, so will be cautious on existing positions moving into that time frame.

The following are top ideas, current, and potential positions. I am deviating away from purely posting SPX (seems to get boring and secondly haven't made the right calls past month :p) Some are duplicative of what I posted previously. Goes without saying: please do your own due diligence and evaluate your own risk tolerance.

I intend to update this at the start of the week, mid week update, and EOW review. For more up to date information, you can just follow me on stocktwits: runner417.

Top 3 Ideas - week of 11/17/13

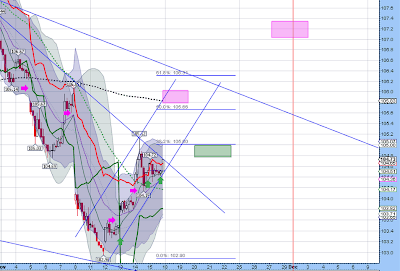

1. Long NUGT [Gold Miners] (discl: O/W position on NUGT)

Looking for explosive move in NUGT this week. Potential IHS, positive reversal on CCI 8 (short term momentum), falling bullish wedge on hourly on Friday, extreme negative sentiment on gold miners, IT/LT hourly cycle moving up, ST cycle bottomed on Friday.

Potential max target ~high 50s so a move of approx. +30%-40% potentially

A gap down Monday may nix this setup so I will be watching before market hours and open.

2. Long EDC/EEM [Emerging Markets] (discl: no posn currently)

Huge gap up on Friday indicates big time mood change. Emerging markets has significantly underperformed SPX during the past several months, needs to play catch-up a bit. Possible asset allocation among fund managers as SPX has been in semi-melt up mode but similar risk assets have been imploding. Looking for a minor retrace to digest gains Mon/Tues and then a possible completion of a C leg up from 28.5 to 32.5 [EDC] (approx 10-15+% move)

3. Long UGAZ [Natural Gas] (discl: no posn currently)

Natural gas has been a short's heaven ever since 2009. I'm no pro at the underpinnings of natural gas but based on the chart I see and from evaluating the cycles, I'm looking for a retrace to around 13.5 on UGAZ Mon/Tuesday and then a rise into end of week with the potential of capping in the 16-17s range so this translates to an approximately 20-25% rise from 13.5. I think natural gas has the potential for making a bullish run.

Existing Positions outside of Top Ideas for this week

1. Long TLT [20Y govvies] [discl: long]

Big picture I don't like government bonds at all but TLT's been beaten down quite a bit and the LT/ST cycle hourlies are moving up this week so hence I'm long. I will look to be disposing TLT towards end of the week. This doesn't generate enough ROA to allow a decent allocation but I thought it was oversold enough.

The long term bond bull run is nearing its end and we're probably at the cusp of the turning point. I think there has increasingly been negative sentiment towards bonds so bonds are going to zigzag all the time but bottom line is it's not something I want to own into 2020. With the billions of $ in bonds, this money will eventually flow elsewhere and it's going to go into the cream of the crop assets....that very well likely could be one last MASSIVE melt up run into stocks (current meltup will look like kiddie meltup when this goes into hyperdrive). Think about it, when you manage your 401k the top two choices are bonds or stocks. Well, if bonds are hitting the crapper, then your other alternatives are stocks and cash. Since stocks are performing so much better and Fed rates near 0, what else can you do?

So moving into next two years, bonds are going to get hit hard and stocks are going to the moon. This might be the last bubble for stocks and in this case it's the entire US stock market (not just some sector like housing or tech). This has very dire consequences and a crisis that will make 2008 look like it was nothing. Meltups never ever end well (go back 1000 years and look at every bubble that has transpired). That is the concern moving into two years from now. In the meantime, there is nothing one can do about it but it will come like winter arrives after fall.

2. Long SPXU (short SPX) [discl: long]

What has been frustrating this year has been the SPX. Didn't think the semi-meltup would be this quick but lo and behold this year SPX is up +25% YTD. Wow. Anyway, I missed the October rally and have not been right in November as well so it gives me some nervousness to make a call on SPX.

I have a tight stop on SPXU but STILL think a near term correction is in the works before another rally into year end.

Potential Positions outside of Top Ideas

1. Long UVXY [volatility]

This goes hand in hand with a short SPX call. UVXY looks to have bottomed ST so I'm trying to get a 5-10% pop on this before selling it. Can't hold this thing for any longer than a few days.

2. Long YINN [China]

China released sweeping reform notably relaxing the one child policy. I think China is making the right adjustments as they position themselves in the early stages of what is clearly a massive up cycle. China reminds me of the late 80s US so it's time in the spotlight will come. There will be more and more opportunities in China.

YINN popped huge on Friday (+10%). I think there is a small retrace and then I want to position myself for a leg up towards EOW.

3. Long DRN (Real Estate)

I don't really know what to make of it but RE, commodities, emerging markets have all sucked hard while SPX has been making new all time highs each day. Real Estate looks to have made a short term bottom so I'm looking to grab a position this week for a leg up.

No comments:

Post a Comment